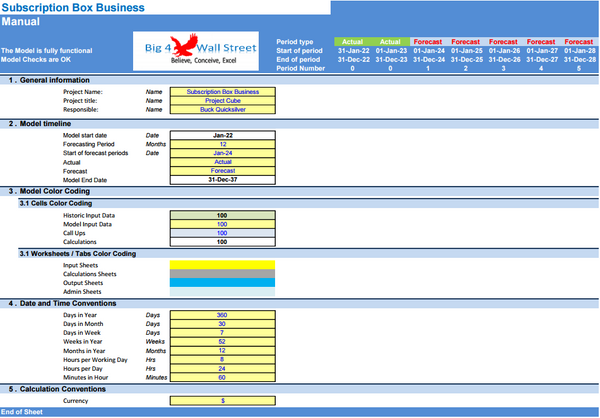

Subscription Box Business - Financial Model Complete (10+ Yrs. DCF and Valuation)

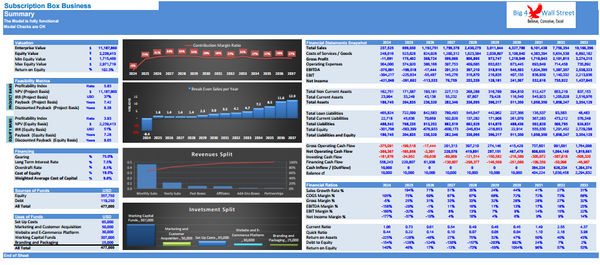

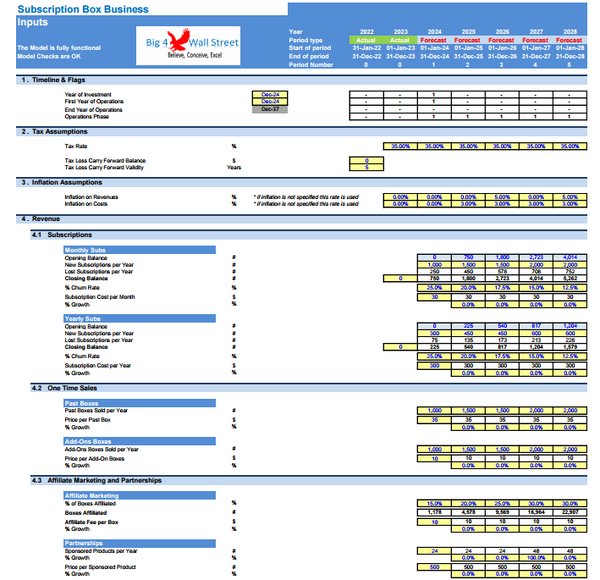

The Subscription Box Business Financial Model with 10+ Years DCF (Discounted Cash Flow) and Valuation provides a comprehensive analysis of the financial aspects of a subscription box service. It includes detailed projections for subscriber growth, churn rate, acquisition costs, and lifetime value. This model helps in understanding the long-term financial performance, revenue potential, and profitability of the subscription box business, enabling informed decision-making and strategic planning. Additionally, it produces financial statements, valuation, and break-even analysis.

Key Components:

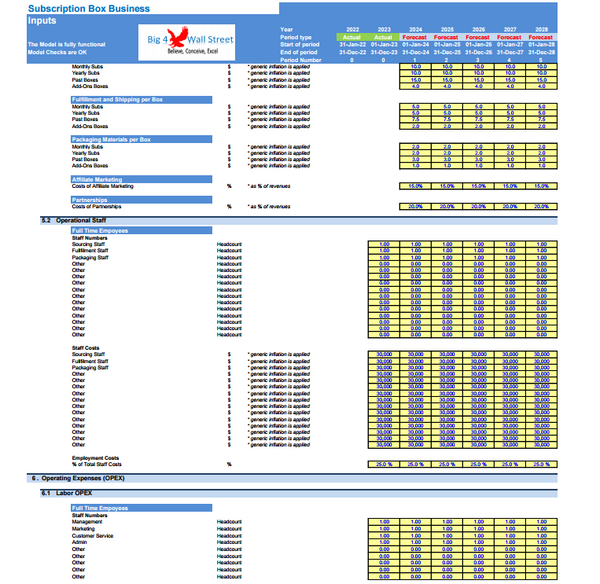

1. Subscriber Growth: Projections for new subscribers.

2. Churn Rate: Monthly percentage of subscribers who cancel their subscriptions.

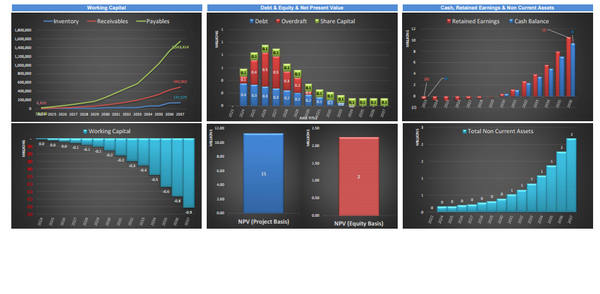

3. Revenue Streams: Recurring revenue from subscription fees, one-time sales, and affiliated marketing and sponsorships.

4. Cost of Goods Sold (COGS): Direct costs associated with producing and delivering the subscription boxes.

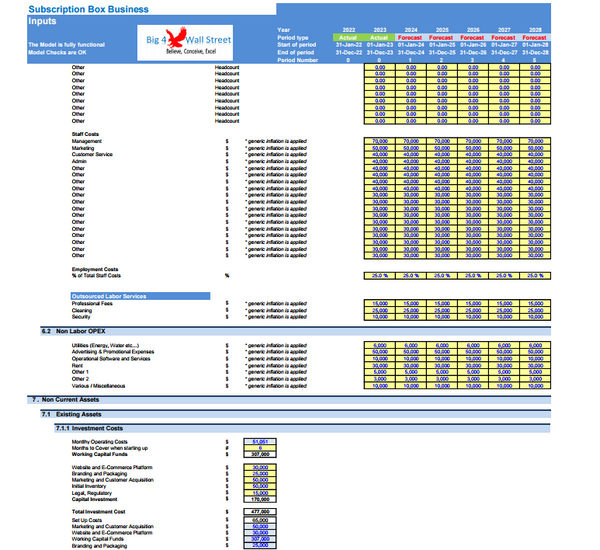

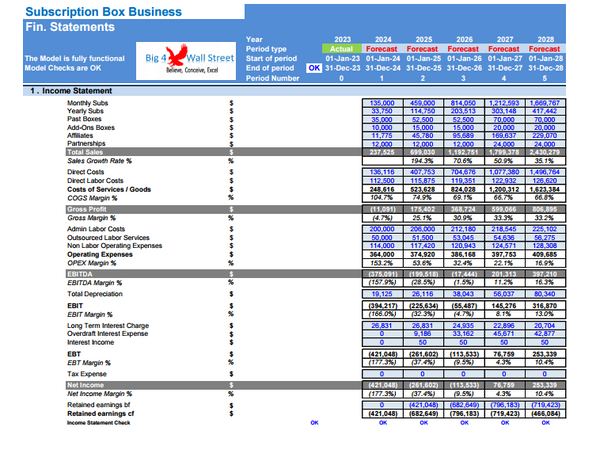

5. Operating Expenses: Administrative, marketing, and other operational costs.

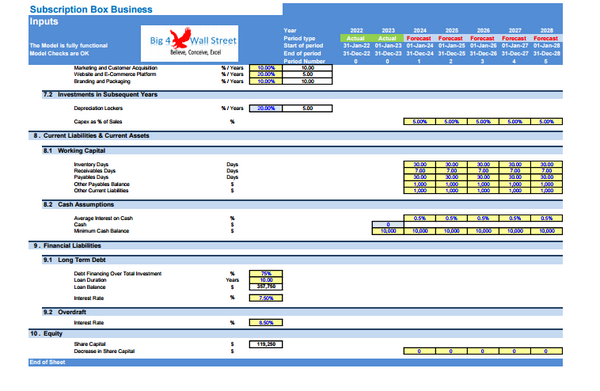

6. Capital Expenditures (CapEx): Investments in technology, fulfillment, and infrastructure.

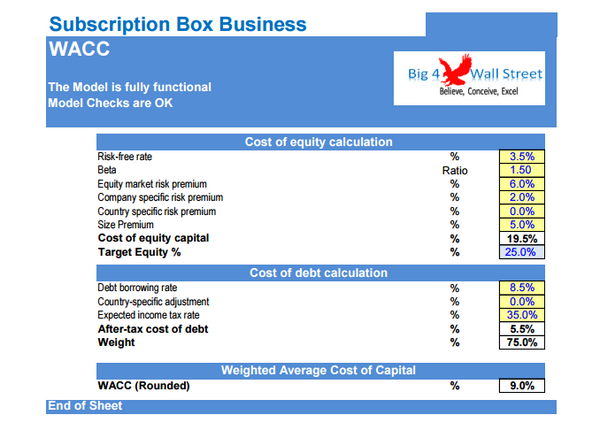

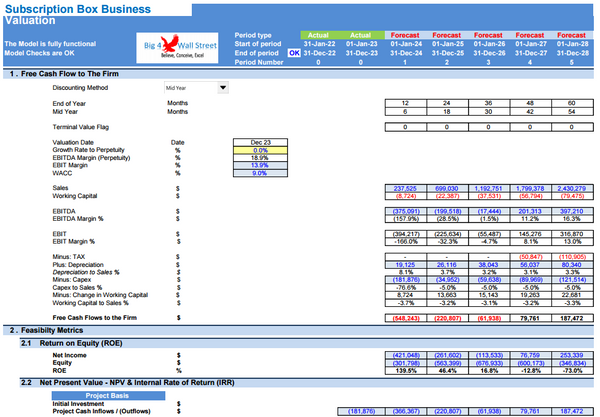

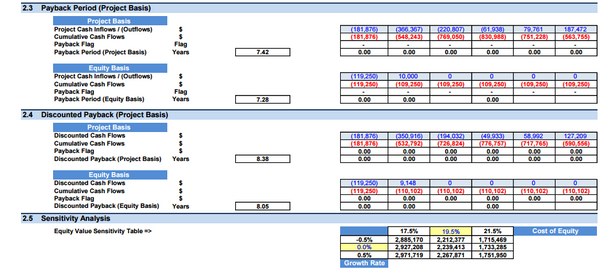

7. 10+ Years DCF and Valuation: Long-term financial projections, including DCF analysis to assess the business's value and ROI.

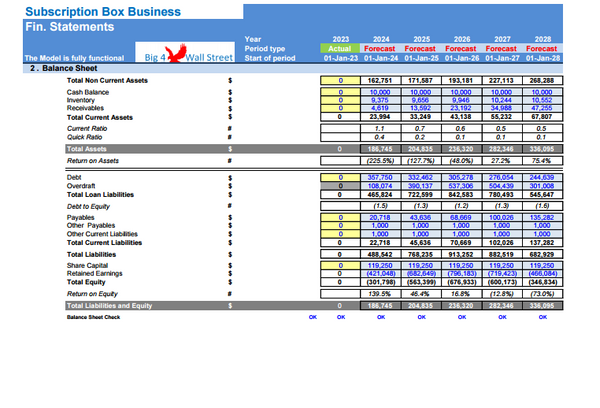

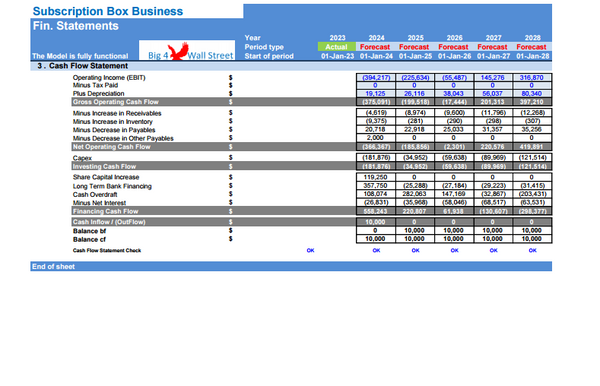

8. Financial Statements: Projections of the income statement, balance sheet, and cash flow statement.

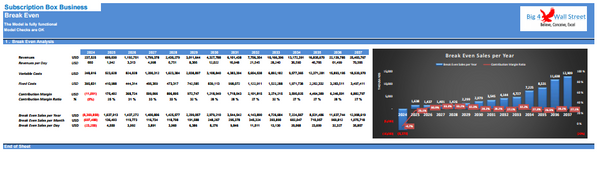

9. Break-Even Analysis: Calculation of the break-even point based on fixed and variable costs.

Key Benefits:

1. Informed Decision Making: Provides detailed insights into cost structures, revenue streams, and profitability.

2. Strategic Planning: Helps in planning marketing strategies and customer acquisition efforts.

3. Profitability Analysis: Assesses the financial viability of different pricing strategies and product lines.

4. Investment Appeal: A robust financial model to present to potential investors and secure funding.