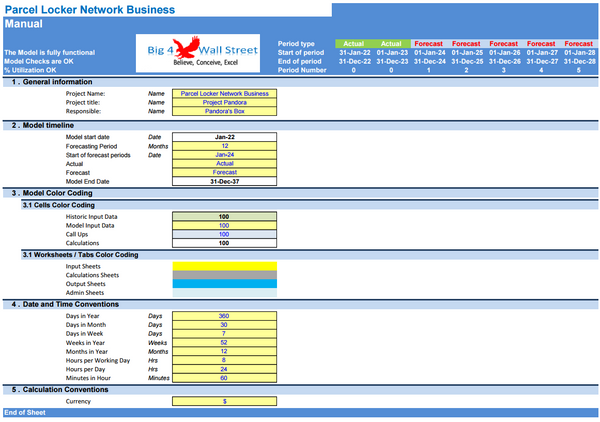

Parcel Locker Network Business Financial Model (10+ Yrs. DCF and Valuation)

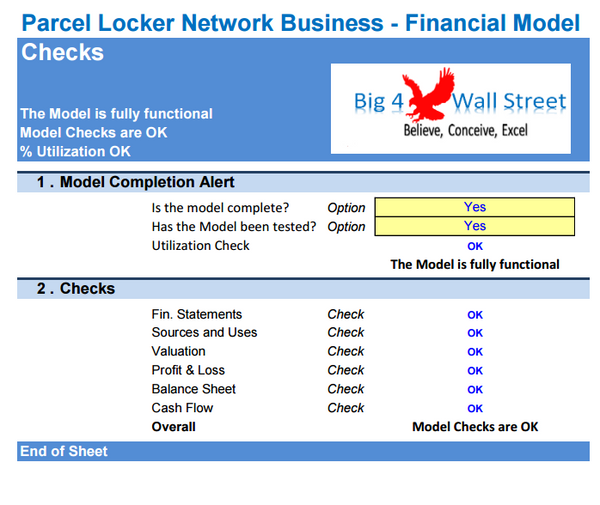

The Parcel Locker Network Business Financial Model is a comprehensive tool designed to analyze the financial aspects of operating a parcel locker network. It encompasses key components such as revenue projections, operating expenses, network expansion costs, pricing strategies, and long-term financial valuation. This model provides insights into the financial performance and value potential of the parcel locker network business, enabling informed decision-making, investment assessment, and strategic planning.

Key Components:

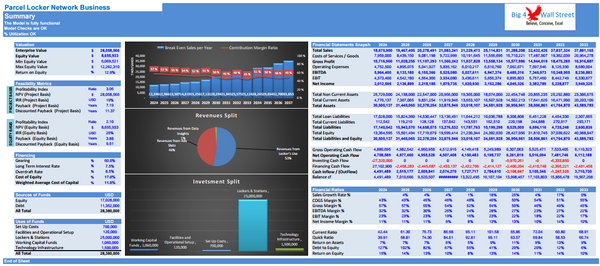

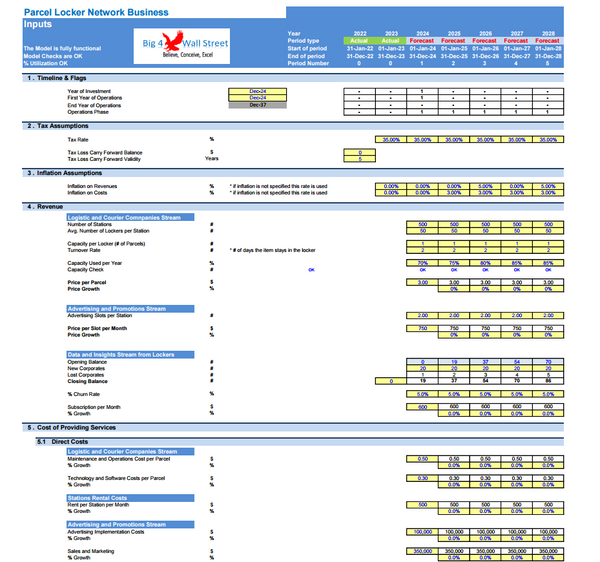

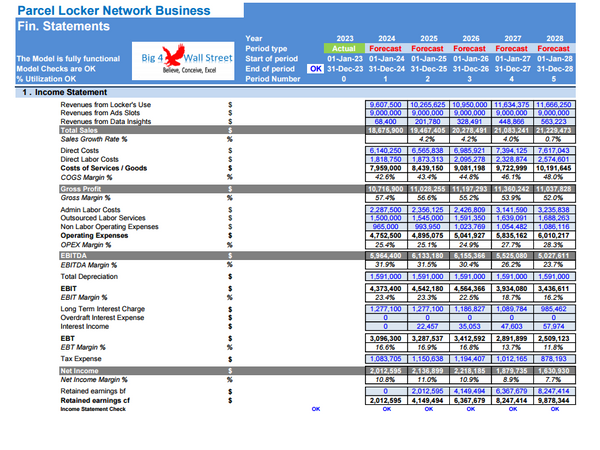

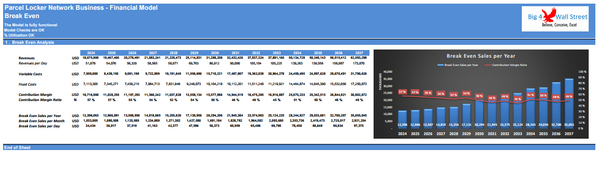

- Revenue Projections: The model assesses revenue sources from rental fees charged to logistics companies and retail partners for using the parcel lockers, as well as potential revenue from value-added services such as advertising or additional storage options.

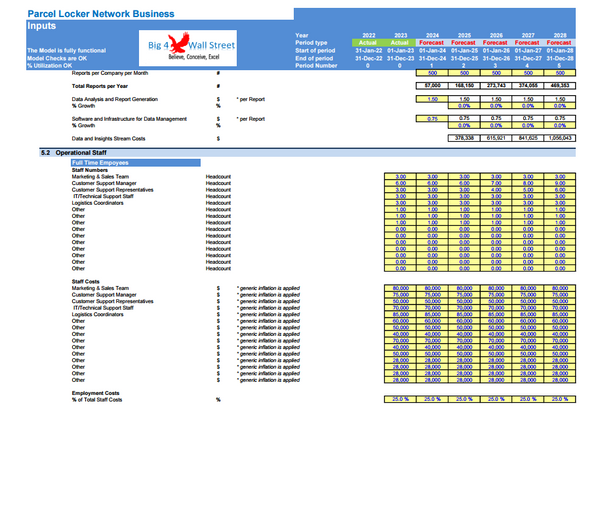

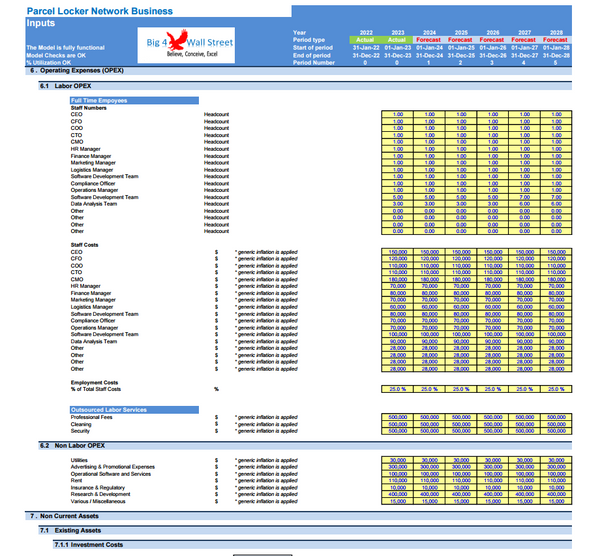

- Operating Expenses: It includes costs for acquiring, installing, and maintaining parcel lockers, as well as expenses related to network operations, customer support, marketing, and administrative overhead.

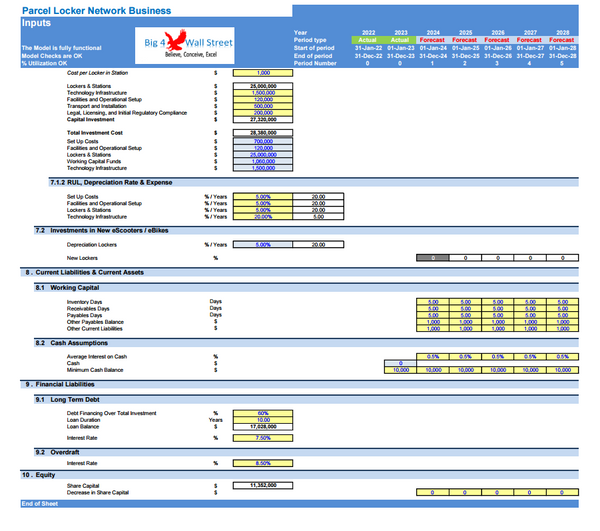

- Network Expansion Costs: The model accounts for the capital expenditures required to expand the parcel locker network, including the purchase of additional lockers.

- Pricing Strategies: It considers competitive pricing while factoring in costs to determine rental rates for parcel lockers that ensure profitability and remain attractive to logistics partners and retail clients.

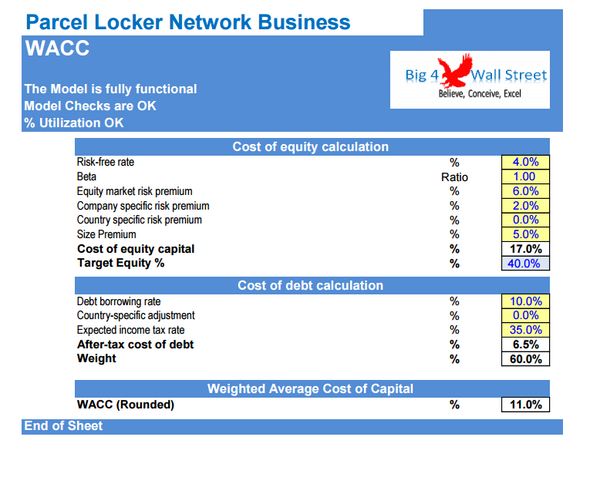

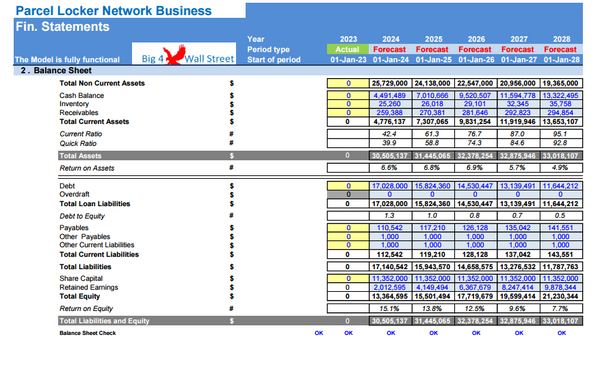

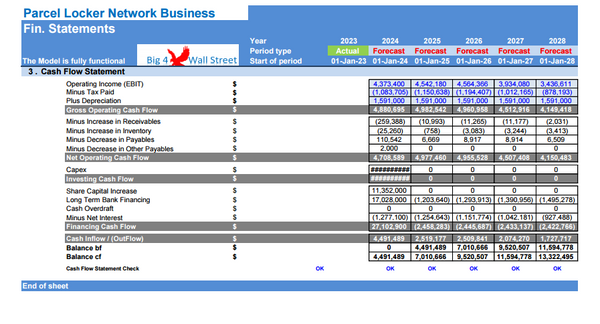

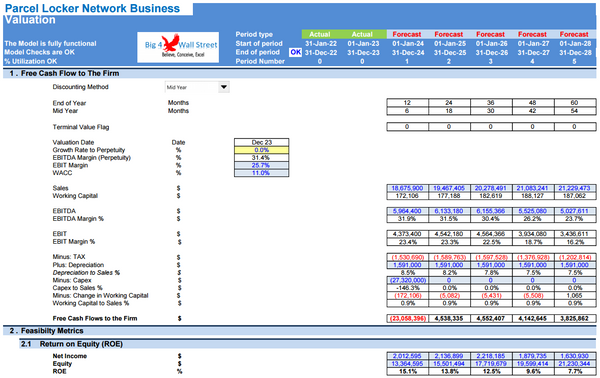

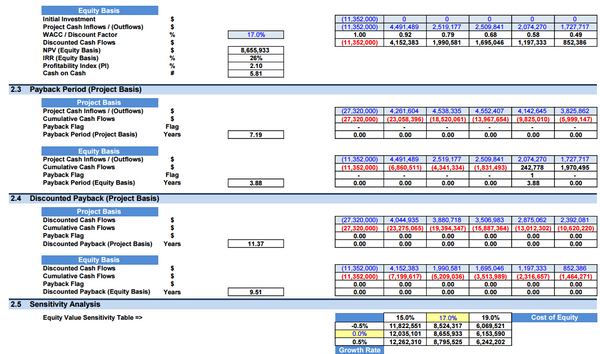

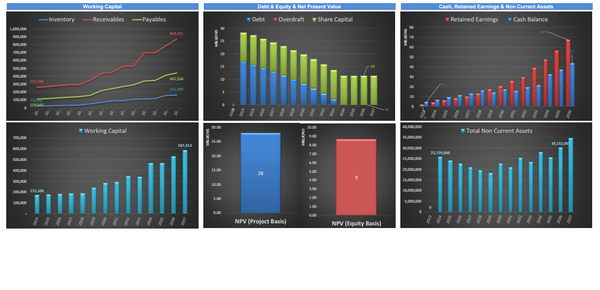

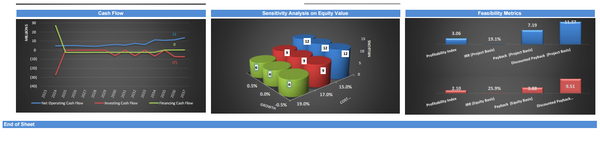

- Financial Statements & Long-Term Financial Valuation: The model employs financial valuation methods to assess the long-term value and return on investment of the parcel locker network business, aiding in strategic decision-making and investor communication.

Key Benefits:

- Informed Decision Making: The Parcel Locker Network Business Financial Model empowers stakeholders to make data-driven decisions regarding network expansion, pricing strategies, customer acquisition, and resource allocation.

- Investment Assessment: Financial projections and valuation methods provide insights into the business's long-term value and profitability, aiding investment assessment, attracting investors, and securing financing.

- Strategic Planning: The model supports strategic planning by allowing stakeholders to assess the potential outcomes of network expansion, market penetration, and service diversification, enabling the formulation of actionable strategies for growth and competitiveness.

- Operational Efficiency: By analyzing revenue streams, operating expenses, and network expansion costs, the model helps identify opportunities for cost optimization, process improvement, and revenue enhancement, contributing to operational efficiency and profitability.

In summary, the Parcel Locker Network Business Financial Model offers valuable insights into the financial performance and value potential of operating a parcel locker network. It supports informed decision-making, investment assessment, strategic planning, and operational efficiency, all of which contribute to the success and profitability of the parcel locker network business.